Connect with the author

Carbon pricing policies place fees on emitters of carbon dioxide, based on the amounts of this gas (CO2) they produce. There are two main types of carbon pricing programs: carbon taxes charged for each ton of CO2 emissions; and cap-and-trade programs that allow producers who need to emit more carbon dioxide than their quota to buy unused emission “credits” from other producers. These approaches obviously raise the cost of emissions and should therefore encourage reductions. Such programs can be politically controversial, yet political support can grow if they are fair to those affected and offer tangible, widely distributed public benefits.

Communicating benefits to the public is critical because citizens are often confused about carbon pricing. Unless such programs are clearly explained, they are vulnerable to critics who say they harm working-class families by raising energy prices. Furthermore, unless authorities spend the revenues raised by these programs in ways that obviously benefit many members of the public, political support can quickly dwindle. Carbon pricing programs can further green economic development, but general promises of this sort may fail to address salient public concerns about higher energy prices or job losses in carbon-intensive industries.

Carbon Taxes versus Cap-and-Trade

Despite growing interest in carbon taxes, cap-and-trade programs remain the most common form of carbon pricing in the world today. According to the World Bank, in 2018, approximately two gigatonnes of emissions (of CO2 or CO2 equivalents) were covered by a carbon tax that generated approximately $25 billion in revenue, whereas five gigatonnes were covered by emissions trading programs that generated approximately $56 billion in revenue.

Carbon taxes have important advantages. They create predictable prices for market actors, and are less costly to administer for some types of emissions. Nevertheless, cap-and-trade programs also have several key advantages over carbon taxes. Because they set caps on total emissions, cap-and-trade programs offer more certain environmental benefits. Unlike taxes, cap-and-trade programs allow carbon emissions prices to vary with economic conditions, rather than locking in a fixed price. In addition, the largest emissions trading programs now auction a majority of their allowances to emitters, rather than giving allowances away. The revenue this approach generates can then be used to benefit the public and increase political support.

Public Benefits from Carbon Pricing Revenue

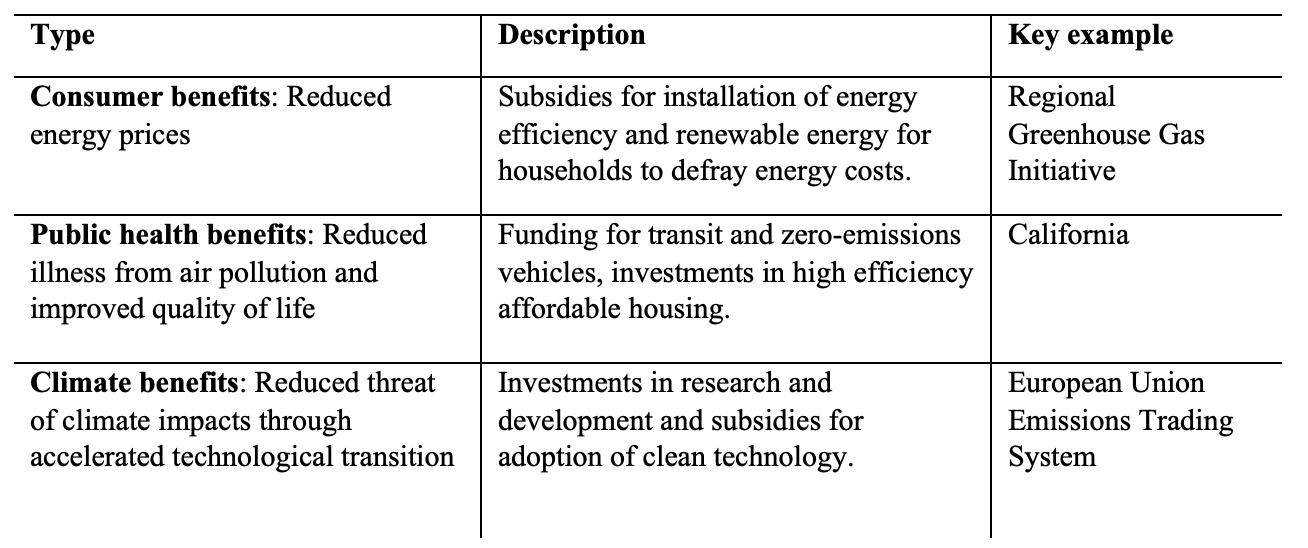

The table above suggests the kinds of public benefits paid for by revenues from carbon reduction programs in several large, long-running cap-and-trade programs. Policy designers should understand that tangible benefits such as these could build support for durable carbon reduction programs, whether taxes or cap-and-trade. What is more, in addition to the benefits listed here, revenues raised by taxes or by auctioning emissions permits can be used to spread green technologies and create new green jobs.

In each of the above cases, benefits were provided to energy consumers, even if the policy generated additional public benefits. In California, for example, one of the world’s first “carbon dividends” was listed as a credit on electricity bills, in order to increase public acceptance. The state simultaneously invested in improving public health and quality of life in many disadvantaged communities. The European Union has invested in low- and zero-carbon technologies, while also providing some consumer benefits.

When policymakers fail to address consumer costs, building public support is difficult. For example, Ontario promoted its 2016 carbon cap-and-trade program by emphasizing reduced carbon emissions and new economic development. The program’s opponents were then able to utilize public concerns about higher energy and consumer costs in their attacks. Similarly, supporters of Washington State’s failed 2018 carbon tax initiative promoted investments in greenhouse gas abatement rather than consumer or other public benefits.

Although experience shows that allocating carbon pricing revenue is politically crucial, there is no simple formula for how to use revenues from taxes or auctions to maximize the public acceptance. In different political settings, various kinds of benefits are likely to be important, including those that go beyond simple cash rebates to consumers. However, visible direct benefits to consumers usually matter – because such benefits can go a long way to allay concerns about rising energy costs. Building public support for carbon pricing requires careful attention to policy design alternatives, and the concerns that are most salient for the communities affected by the new policy.

Read more in Leigh Raymond, Reclaiming the Atmospheric Commons: The Regional Greenhouse Gas Initiative and a New Model of Emissions Trading, (MIT University Press, 2016).